Nys Inheritance Tax 2025. Read on to learn the difference between the two and what the estate tax in new york is. The estate tax exclusion has increased to $12.06 million.

The increased estate and gift tax exemption limits are dropping at the end of 2025. The tax is paid by.

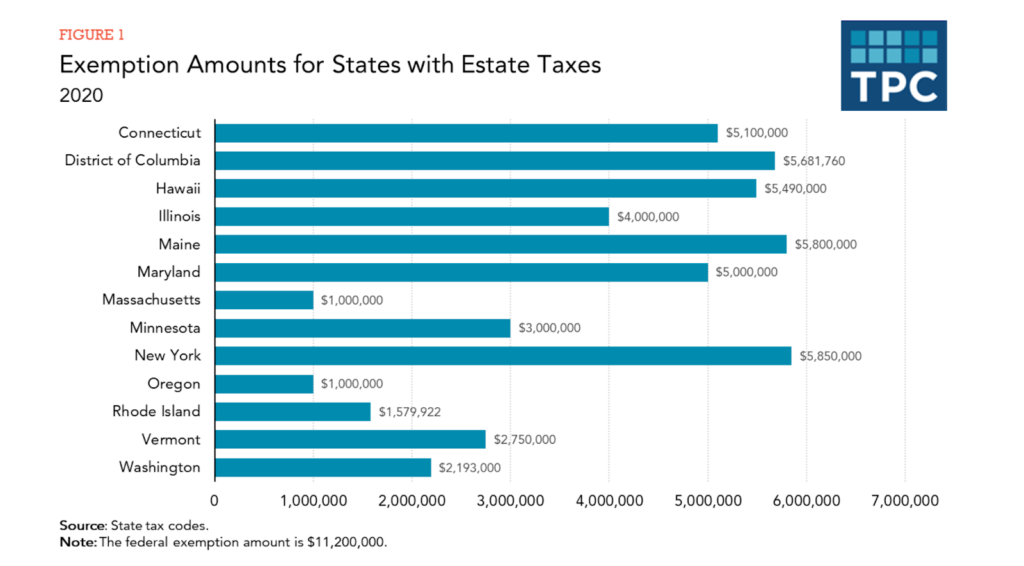

The new york state estate tax exclusion amount will increase to $6,940,000 in 2025 (from $6,580,000 in 2025).

Estate_and_Inheritance_Tax Prosperity Consulting, LLC, The tcja provisions related to the estate tax exemption is set to sunset on december 31, 2025 — causing the exemption limits to revert to approximately $7 million. Learn giving options and take next steps to help reduce estate taxes.

Inheritance Tax Infographic The Private Office, In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025,. New york does not have an “inheritance tax.” inheritance taxes are assessed on the property and money an heir receives from a decedent’s estate.

New York State Inheritance Tax Waiver Form airSlate SignNow, New york estate tax rate: The estate tax is computed based on the new york taxable estate of a resident or nonresident using the following tax table:

Estate and Inheritance Taxes Urban Institute, Not on most estates, but yes on very large estates. Gray, esq., vice president, estate strategies.

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, As of january 1, 2026, the. New york estate tax rate:

Best Answer Does New York State Have An Inheritance Tax? [The Right, While new york doesn’t charge an inheritance tax, it does include an estate tax in its laws. Understanding taxation for ny estate planning.

All You Need to Now About Inheritance Taxes at Federal and State Level, Gray, esq., vice president, estate strategies. This article reviews the basics of the new york estate tax law and discusses estate planning strategies that can be used to reduce the new york estate tax and help.

:max_bytes(150000):strip_icc()/inheritancetax.asp-final-96944c15e1cc4e17b4b94d7b88eb8cec.jpg)

Inheritance Tax What It Is, How It's Calculated, and Who Pays It, These exemptions can change, so staying up. And you also have to be mindful of the federal inheritance tax, which applies to.

Dupalag Law Office , Notary and Realty Services Home, The current estate and gift tax exemption law sunsets in 2025, and the exemption amount will drop back down to the prior law’s $5 million cap, which when. New york state inheritance tax is a financial obligation imposed on the inheritance received from a deceased person.

Inheritance Tax Planning Gravitate Digital, Understanding taxation for ny estate planning. New york has an estate tax, but it does not have an inheritance tax.

With the impending sunset of the current estate tax exemptions at the end of 2025, there are several strategic planning tools and techniques that can help minimize.